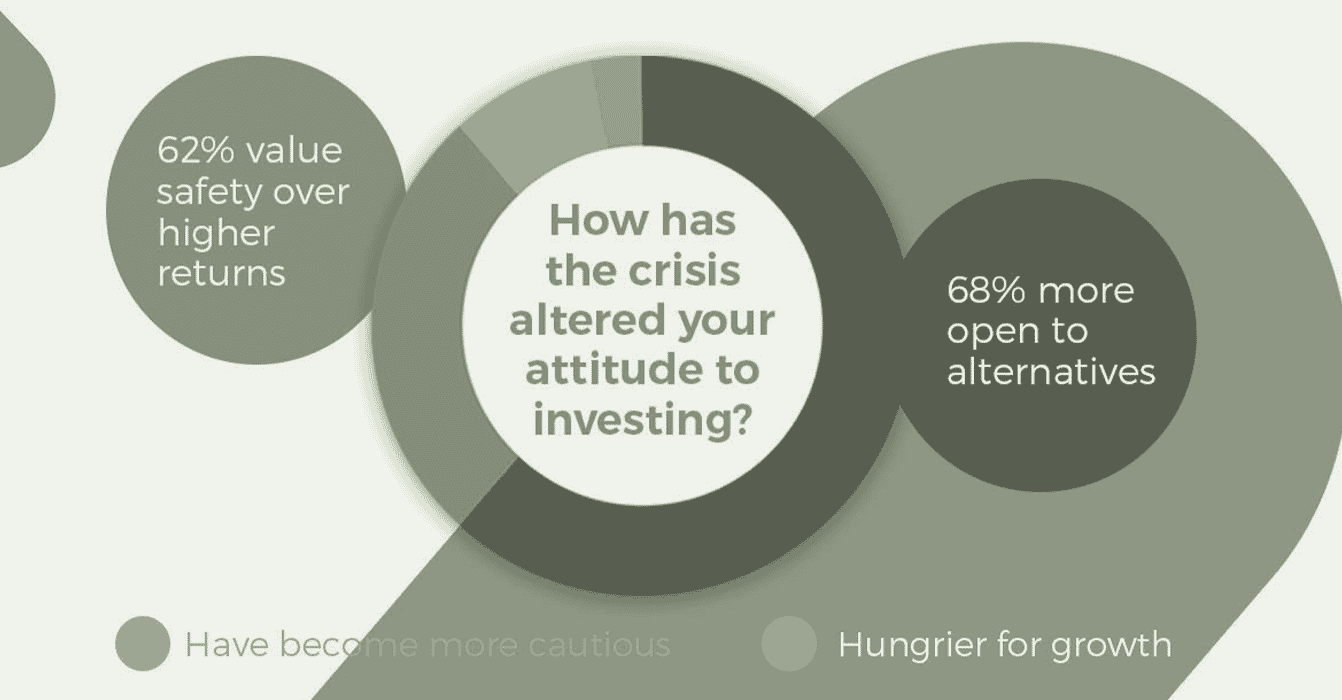

How has the Crisis Altered your Attitude to Investing?

Tightening yields, geopolitical uncertainty, slowing economic growth….and now a global pandemic. The past few years have proved challenging for investors searching for income. The “lower for longer” interest rate environment has become “lower for even longer”. Yet investors must find somewhere to put their money.

A recent survey conducted by Greenman highlighted a majority of investors (40%) are more open to alternatives as an investment choice as a result of the crisis. 37% value safety over higher returns vs 2% willing to take on more risk to achieve greater returns.

Alternative strategies have fulfilled their role as smart-diversifiers during the crisis and investors have sought to diversify their portfolios with income-producing asset classes. In particular, asset classes that have been less impacted by the pandemic, for example renewables, infrastructure or the pandemic “winner” food retail can provide stable sources of income over the long-term.