GMO agrees new debt deal with HypoVereinsbank

Greenman OPEN agrees new debt deal with HypoVereinsbank to finance the acquisition of a sustainable retail park in Brandenburg

Greenman OPEN (GMO), one of the largest food retail-focused investment funds in Germany, has signed a five-year debt deal with HypoVereinsbank (UniCredit Bank AG) for the acquisition of a new retail park in Wittenberge, Germany. The transaction which is a forward fixing loan, represents the fund’s first deal with the bank.

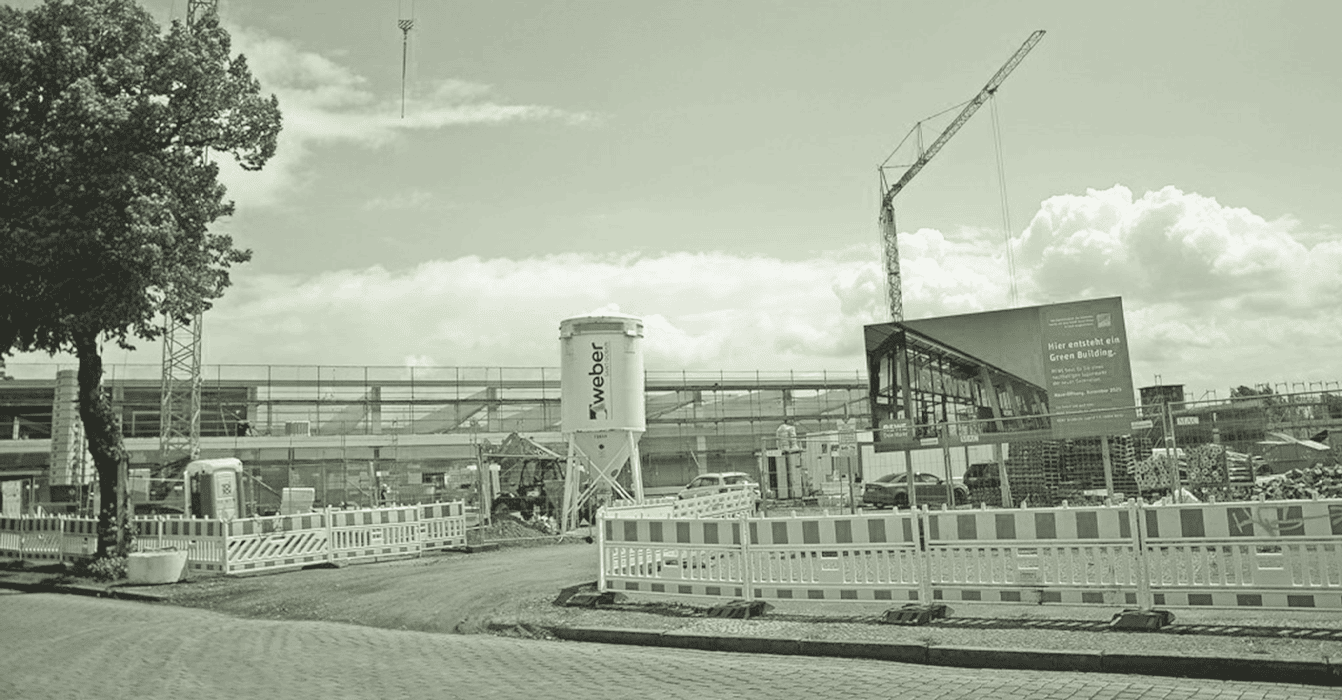

The center is being developed in accordance with strong sustainablity criteria, employing renewable and recyclable building materials throughout the construction phase and will be anchored by REWE. Comprising a total of 4,700 square metres of leasable space, the fully let asset has an average lease term (WALT) of 13.3 years and is scheduled to open in November this year.

Neil Hennessy, Head of Debt Capital Markets at Greenman, says: “We are delighted to have gained another long-established financing partner in HypoVereinsbank. With the addition of the retail park in Wittenberge to GMO’s portfolio, we are not only adding value for our investors, but also for society and the environment at the same time.”

Manfred Drießen, Real Estate Finance Expert at HypoVereinsbank in Frankfurt, commented, “We are delighted to partner with investment and food retail specialist Greenman and to be playing our part in delivering a flagship retail project with sustainability in mind.”

GMO was legally advised on the financing by the law firm White & Case from Frankfurt. As a certified “Light Green” fund under Article 8 of the EU Sustainable Finance Disclosure Regulation, ESG factors are an integral part of GMO’s investment and development process and play an important role in future-proofing investments.

The fund is increasingly investing in sustainable real estate in order to meet its target to become carbon-neutral by 2040. It currently has a volume of € 913 million under management. The properties in the fund operate with long-term leases and offer investors a regular and secure income.